On April 14, 2023, Nodira Kalonova and Marifat Abdurakhmanova represented Financial Chain Corporation in the event under the program of “Effective Governance for Economic Development (EGED),” held with the financial support of the Government of the United Kingdom in Tajikistan, and implemented by ACTED Tajikistan in cooperation with the World Bank Tajikistan within the Zoom platform. The following topics were discussed at the event:

1) “Income of Non-Profit Organizations,”

2) “Peculiarities of the taxation of international consultants.”

The program is funded by the UK Government and implemented by the World Bank under the concept introduced in its 1992 report entitled “Governance and Development,” for improvement of the effectiveness, accountability, and transparency of economic policies in Central Asia (Tajikistan, Uzbekistan, and Kyrgyzstan) by supporting the governments of these countries to generate better data and evidence and use this data for the implementation of economic reforms, the improvement of coordination within the government, and better engagement with citizens. Good governance includes the sustainable use of natural resources and the protection of the environment. The representatives of parties with a wide range of interests received the answers to the topical questions on the tax assessment of non-commercial organizations.

The speaker of the event, Sobir Vazirov, Deputy Head of the Tax Legislation Improvement Department of the Tax Committee under the Government of Tajikistan, presented two main topics to more than 40 participants in the session.

The issues of tax regulations for non-profit organizations receiving grants always require clarification among the recipients of grants. In particular, questions of assessment of sub-grants’ taxation and contracts for services provided by representatives of public organizations were among the issues discussed at the event.

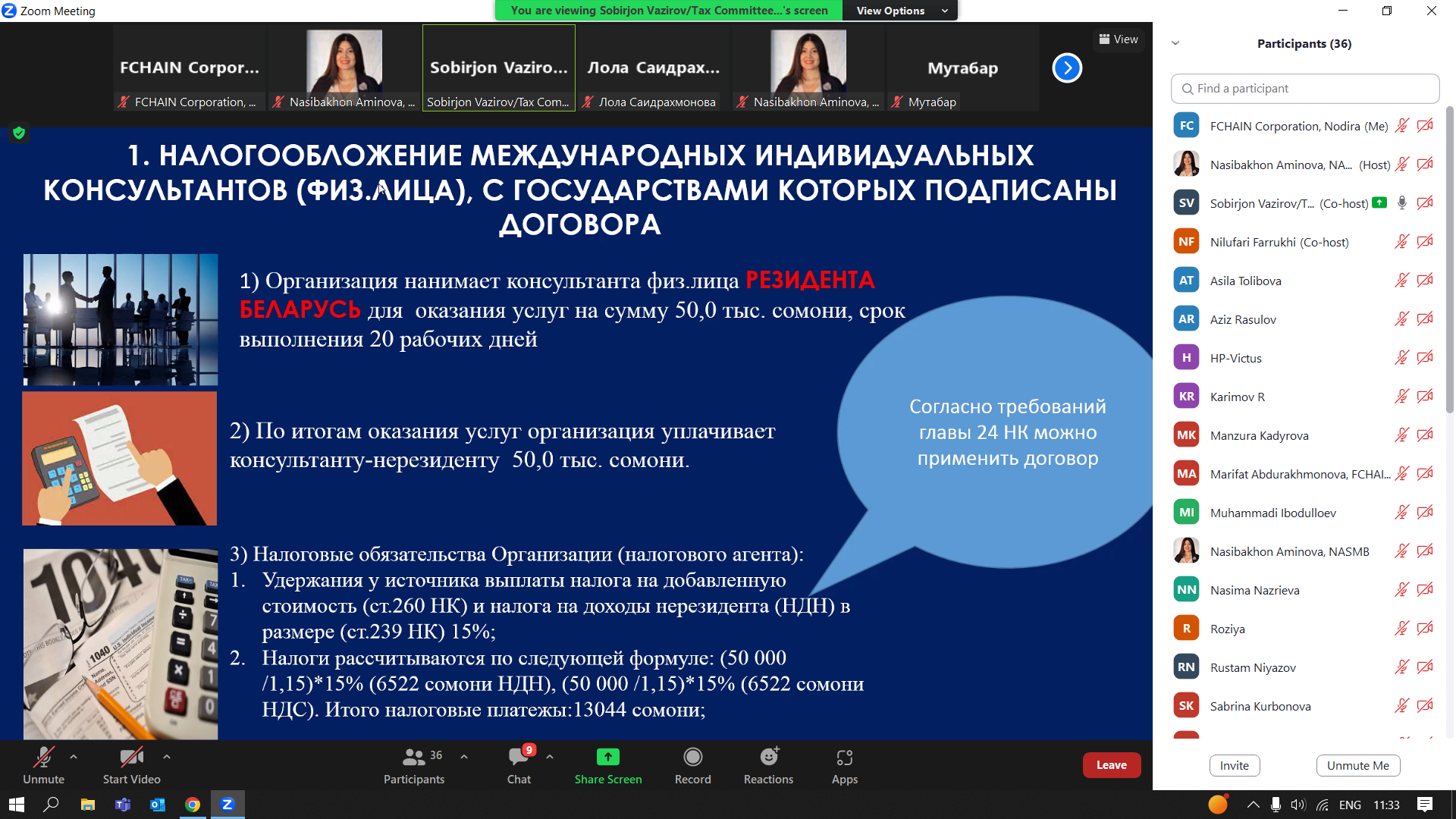

The question of the taxation of international consultants hired by the local NGOs sparked a lively discussion at the event, being very important. The presentation included the peculiarities of hiring non-residents, taking into account the existing agreements of the Republic of Tajikistan, avoidance of double taxation, and income tax evasion.